Private equity (PE) firms have increasingly focused on the sports industry, recognizing its lucrative opportunities. From acquiring stakes in professional teams to investing in sports technology and infrastructure, PE firms are playing a pivotal role in transforming the sports landscape. This article explores the transformative impact of private equity investments in sports.

The Appeal of Sports Investments for Private Equity

The sports industry appeals to private equity for several reasons. Sports franchises and related assets often have strong brand loyalty and dedicated fan bases, providing a stable revenue stream. What’s more, the global growth of sports, along with increasing media rights and sponsorship deals, offers significant potential for financial returns.

The Broader Impact of PE Investments in Sports

Private equity’s involvement in sports extends beyond team ownership to include investments in sports technology, media rights, and infrastructure:

-

Sports Technology: PE firms fund innovations like wearable technology, data analytics, and virtual reality to enhance athlete performance and fan engagement.

-

Media Rights and Content: There’s a growing demand for sports content, prompting PE firms to acquire media rights and invest in content production, expanding global sports reach.

-

Sports Infrastructure: Investment in modern stadiums and training facilities enhances fan experience, increases revenue, and supports athlete development.

Benevolent Capital’s Investment Strategy

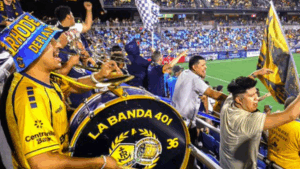

At Benevolent Capital, we believe in the profound social and economic impact of professional sports investments, which go beyond financial returns to include community engagement and cultural influence. Our investment in Phoenix Rising FC, for example, has driven local economic activity through tourism, job creation, and community spirit, while our involvement with Ipswich Town Football Club taps into the lucrative European football market, showcasing the global reach of strategic sports investments.

Our commitment to social impact is evident in our investment in Rhode Island FC, a team deeply rooted in its community. Rhode Island FC has become a local beacon through initiatives such as youth development programs and community outreach, fostering a strong bond with fans and driving local engagement. These efforts enrich the community and build loyal fan bases, enhancing long-term value and equity appreciation. By selecting teams with growth potential in the right leagues and geographies, we achieve significant returns and contribute to the social and economic fabric of the communities we invest in, reinforcing our belief in the transformative power of sports investments.

Challenges and Opportunities

While the opportunities are vast, investing in sports also comes with challenges. The sports industry can be volatile, with team performance, regulatory changes, and economic factors affecting profitability. However, private equity firms are well-equipped to navigate these challenges due to their financial expertise, strategic management, and ability to leverage diverse investment portfolios.

PE firms are reshaping the sports industry through investments in teams, technology, media, and infrastructure. As the industry evolves, private equity’s role is poised to grow, offering exciting prospects for investors and sports organizations alike.

About the Author

Brett M. Johnson is the founder and CEO of Benevolent Capital, founder and partner of Fortuitous Partners, and co-founder and chairman of Rhode Island FC. He holds a bachelor’s degree from Brown University and an MBA from Pepperdine University’s Presidential/Key Executive program, with additional leadership training from Harvard Business School’s President’s Leadership Program in 2014. Brett is an active member of the Young Presidents Organization.

*Disclaimer: The information provided is for informational purposes only and should not be construed as financial or investment advice. Always consult with a qualified financial advisor or wealth manager before making any investment decisions.